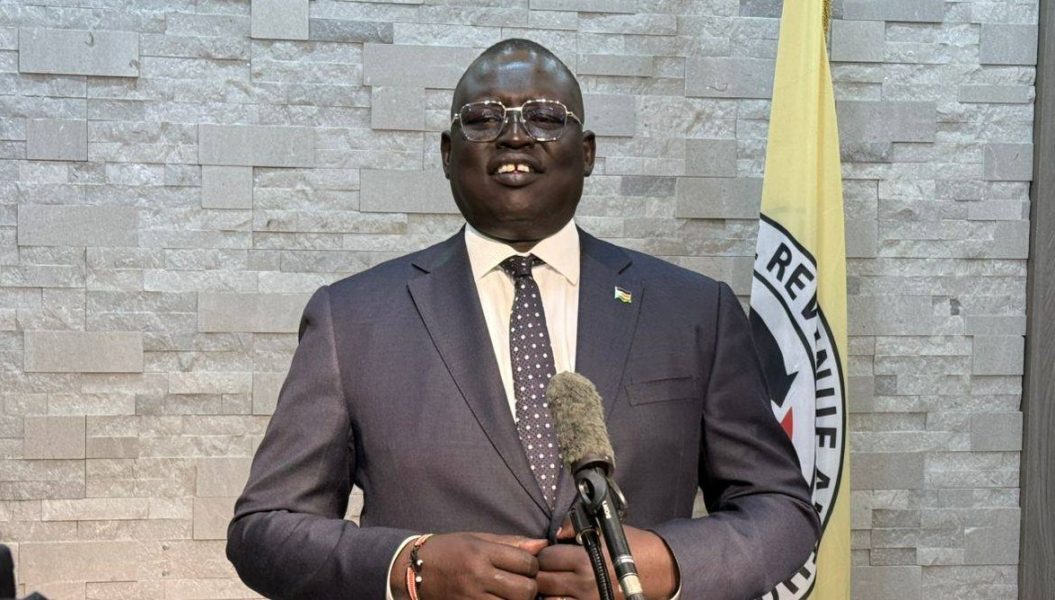

The Commissioner General of the South Sudan Revenue Authority (SSRA), Simon Akuei Deng, has spoken out for the first time on the growing tension over tax collection between national and state governments, revealing plans to introduce a new Tax Procedure Act to address the confusion.

Speaking to reporters at the SSRA headquarters in Juba on Tuesday, Deng said the agency is working on a comprehensive bill that will clearly define the taxation roles of national, state, and local governments to end persistent cases of double taxation and jurisdictional disputes.

“The Tax Procedure Act will clearly outline tax responsibilities at all government levels to address the problem of double taxation,” Deng said.

According to him, the current Tax Act of 2009 is outdated and lacks specificity, resulting in overlapping mandates that have frustrated taxpayers and investors alike.

Deng said there are many assumptions about which level of government should collect certain taxes, but no clear legal references, especially at the local level.

“We have a lot of assumptions… but there are no proper references… So as leaders of the SSRA, we are working on this document… and… we will have to hold a tax conference,” he added.

“This tax conference will allow us to build consensus around a streamlined tax structure. It will also prepare the ground for presenting the bill to parliament,” he added.

Deng stressed that a coherent and unified tax system is critical to attracting investment and ensuring sustainable public finance.

“We cannot continue with a muddy tax system. Investors need certainty. They should know who taxes them and why,” he emphasized.

The proposed reforms come amid repeated complaints from businesses about inconsistent taxation practices across the country, with some facing multiple levies from different authorities.

If passed, the Tax Procedure Act is expected to become a cornerstone of South Sudan’s efforts to build a transparent and investor-friendly revenue regime.