The Bank of South Sudan (BOSS) has announced a new round of foreign exchange auctions for Thursday, August 7, 2025.

The move is part of efforts to reassert control over the currency market and reduce reliance on black market dollar trading.

According to the official notice, banks with access to the Refinitiv platform are required to submit bids through the portal, while those without access must email authenticated bid forms in a single PDF file.

The initiative allows eligible commercial banks to submit bids freely quoting their preferred exchange rates and amounts, a market-driven approach aimed at improving transparency, accountability, and confidence in monetary policy.

The auction window is tight, just one hour for bid submissions, with adjudication concluding by 11 AM the same day.

Winning banks are expected to deposit physical cash immediately, with final settlements due within 24 hours.

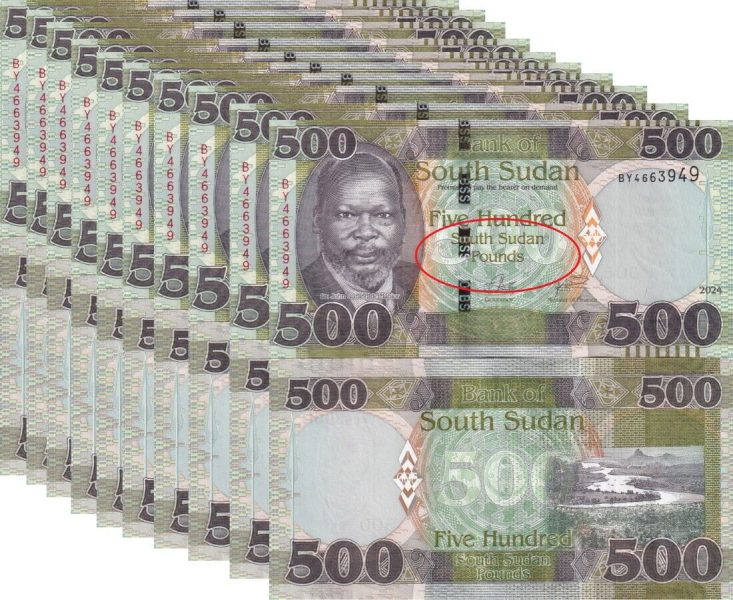

While this isn’t the first time BOSS has used currency auctions to manage liquidity and stabilize the South Sudanese Pound (SSP), the latest round comes at a critical juncture when inflation is high, hard currency is scarce, and public confidence in formal financial institutions remains shaky.

Yet, the question remains: will it help stabilize South Sudan’s economy, which is currently on its knees?

Economists argue that while auctions can help regulate short-term forex volatility, they are not a silver bullet.

The long-term health of South Sudan’s economy hinges on structural reforms: diversifying exports, boosting domestic production, and strengthening public institutions.

Dr. Abraham Maliet, a prominent South Sudanese economist and senior advisor within the National Government’s Economic Cluster, once remarked that while the auctions are a step in the right direction, their impact is likely to be short-lived.

“These auctions are not new to South Sudan. In my view, they won’t have a significant long-term effect.”

Past rounds of auctions have produced mixed results, often hampered by low liquidity, delayed settlements, and persistent concerns over transparency in the bidding and allocation process.

South Sudan’s black market for foreign currency has continued to thrive in recent months, with parallel exchange rates diverging significantly from official rates.

In Juba and other towns, traders have been purchasing dollars at rates SSP 6000 per $1 far above the central bank’s reference, fueling inflation and speculation.

Foreign exchange auctions, if executed transparently, can help allocate scarce U.S. dollars more efficiently, reduce the dominance of the parallel market, and cushion the SSP against extreme depreciation.